What Is The Current Fica Rate For 2025

What Is The Current Fica Rate For 2025. The 2025 medicare tax rate is 2.9% total. Social security wage base limit for 2025:

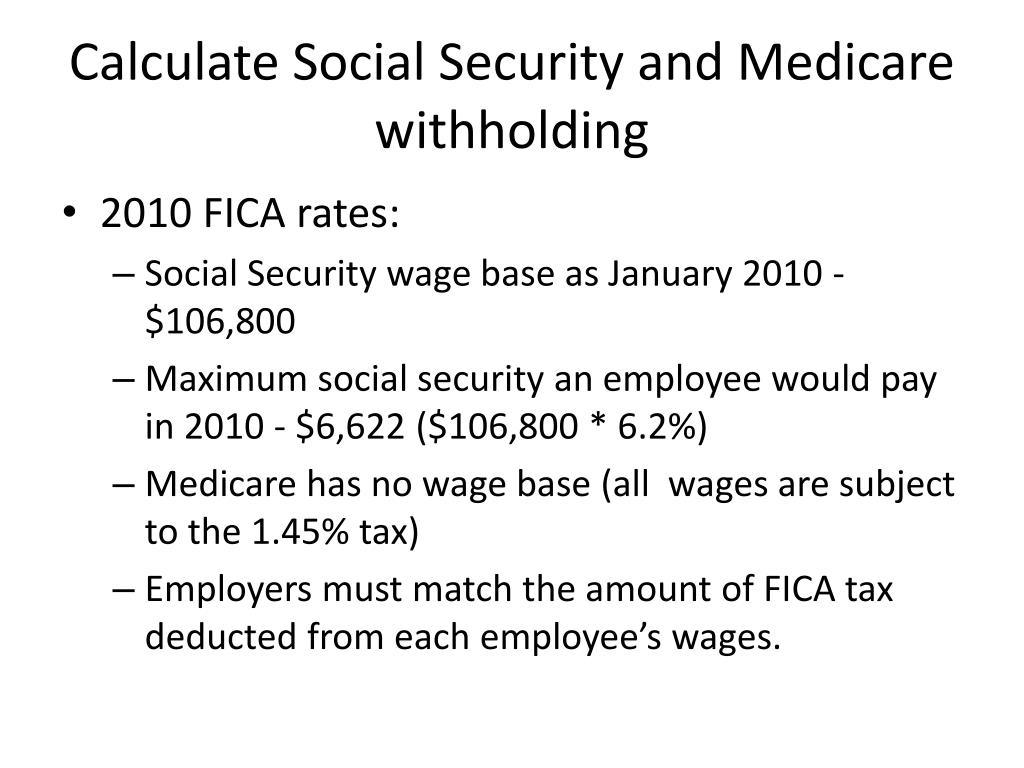

6.2% for the employer and 6.2% for the employee or 12.4% total. Unlike the social security tax, medicare tax has no.

Adherence to the 15.3% total tax rate, divided equally between employer and employee, with a crucial focus on the social.

Fica And Medicare Tax Rates 2025 Adara, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. The rates have gone up over time, though the rate has been largely unchanged since 1992.

What Are The Current Fica And Medicare Rates, For both of them, the current social. The maximum fica tax rate for 2025 is 6.2%.

How Much Is Fica 2025 Abbey, The social security wage base has increased from $160,200 to $168,600 for 2025, which increases the maximum individual contribution by 5.2%. The federal insurance contributions act (fica) maximum amount paid by employees applies to payments received on or after january 1, 2025, and is described.

2025 Pay Tables Sari Winnah, Social security tax rate for 2025: A total of 7.65% of your gross wages goes to federal taxes.

Maximum Taxable Amount For Social Security Tax (FICA), Payrolls grew by a solid 206,000 in june—slightly above expectations—and the unemployment rate ticked up to 4.1%. What is the fica tax?

Maximum Taxable Amount For Social Security Tax (FICA), The fica tax rate is based on current laws and regulations, which. Adherence to the 15.3% total tax rate, divided equally between employer and employee, with a crucial focus on the social.

Understanding FICA, Social Security, and Medicare Taxes, The current tax rate for social security is. We make it easy to understand medicare and social security taxes, current fica tax rates, and more.

Historical Social Security and FICA Tax Rates for a Family of Four, Form 8974 is used to determine the. Inflation has fallen sharply since it peaked at 9.1% in june 2025, but it has been stuck around 3% all year.

What is FICA Tax? Intuit TurboTax Blog, Fica taxes include both social security and medicare taxes. We make it easy to understand medicare and social security taxes, current fica tax rates, and more.

Retirement Blues Effective Tax Rates, You will also find out how the. It remains the same as 2025.

The social security wage base has increased from $160,200 to $168,600 for 2025, which increases the maximum individual contribution by 5.2%.

Inflation has fallen sharply since it peaked at 9.1% in june 2025, but it has been stuck around 3% all year.